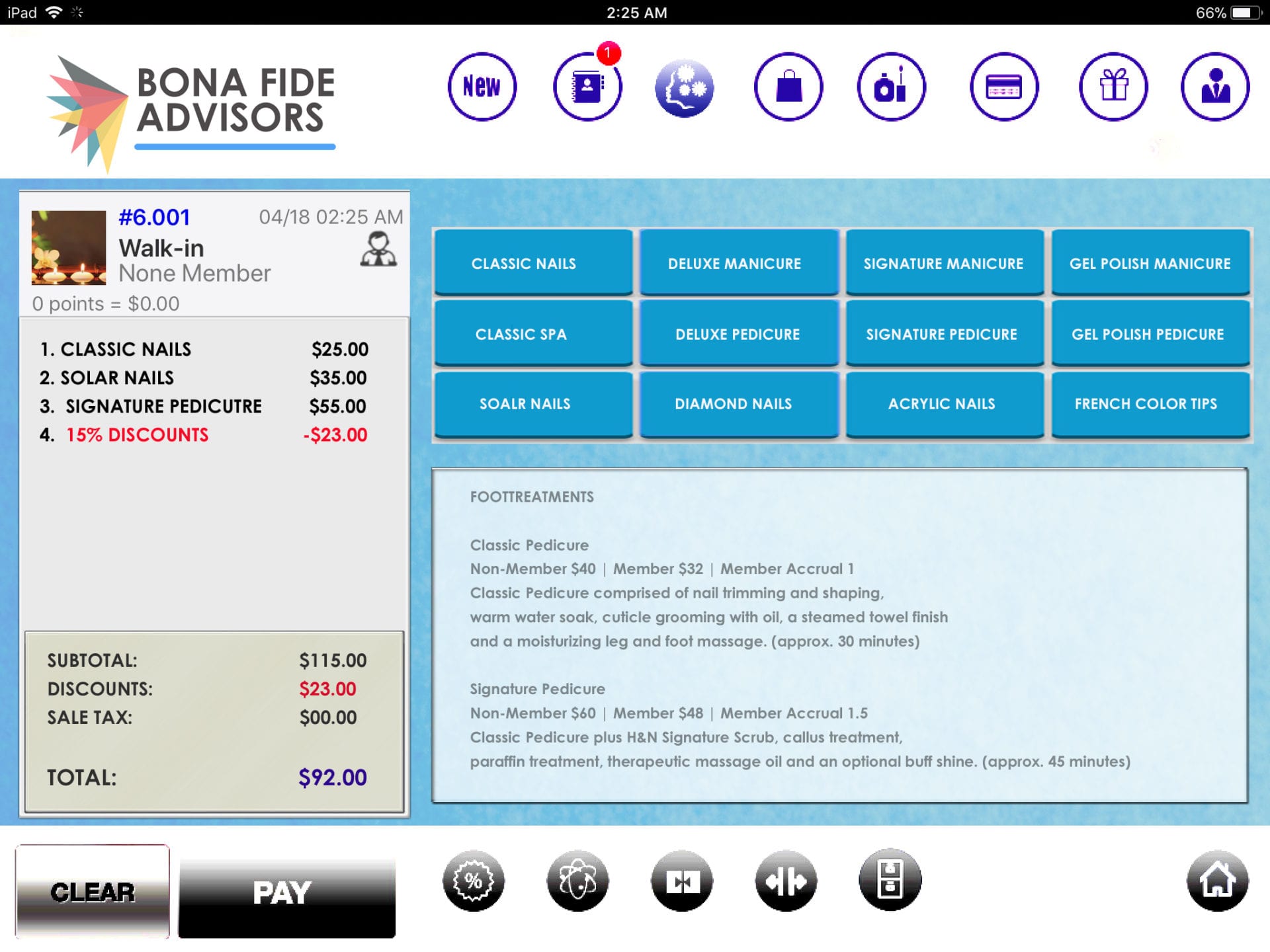

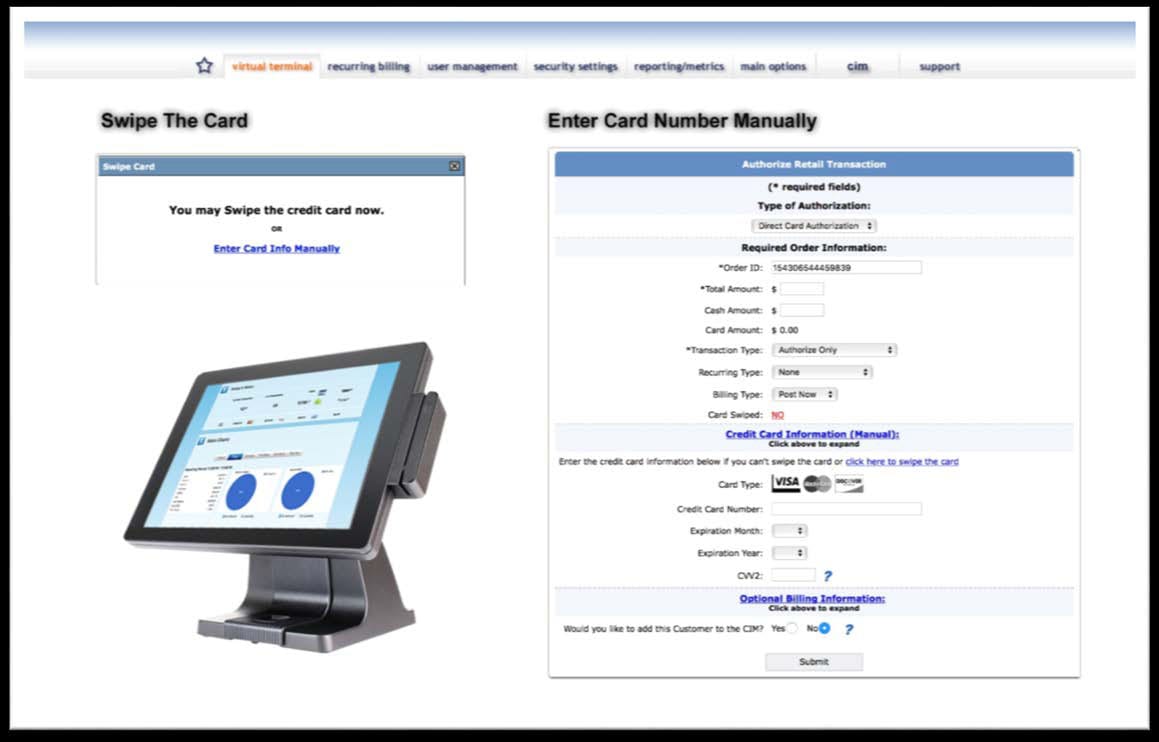

Payments

Finding products that benefit you for your business can be very difficult. Making the decision even more challenging. Our payment solutions have a variety of choices such as In-Store, Online, and Mobile. Our professional trained Bona Fide Advisors give you what payment service, and product solution is best for you according to your business needs. Our main purpose focus to generate the new Revenue area, and to bring your business into the next level of success in professionalism.

Programs

What is EMV?

EMV stands for Europay, MasterCard, Visa. It is a new technology that was introduced to the U.S. in October 2015 due to a massive data breach everywhere in the United States. Historically, EMV standard was used in Europe in 1990 due to phone line card authorization fees costing up to 80% or even 90% higher than U.S. Europe figured out how to cut those cost down by adding an additional layer of security for protecting their card holders and card issuers. EMV was born. Then 25 years later, EMV began to shift to the United States for different reasons to fight against fraud, and to protect the card holder’s personal data information!

For a magnetic strip card, card holders must swipe the card on the credit card terminal; sign on the receipt, and then check the ID at the purchase or at the point of sale. when your 3-digit numbers of CAV2, CVC2, CVV2 gets hacked, the magnetic strip cards are an easy target to duplicate another fake card by the re-encoding of hackers. The all the data & the private information of cardholder is hold in the magnetic strip. It can be not safe, and vulnerable when the 3-digit secure numbers of CAV2, CVC2, CVV2 fall in the bad persons hands. Of course, the stealer can forge the cardholder’s signature to make a purchase.

For EMV cards, it is a game changer with a new security technology to identify the card holder right away without providing a signature or require swiping. EMV cards are safer and it is making it more difficult and even impossible for the hacker to duplicated. EMV cards protects the card holders from the criminal by intercepting data that encodes every single transaction differently. No need to swipe, to sign and the private information is protected.

EMV is the global chip for all universal credit cards which contain an integrated circuit chip. The benefit is not only to cut the cost down but give the card holder an extremely good way to prevent high-profile data breaches. The card issuers begin to shift to EMV to replace the magnetic strip. Now all the POS terminals have been required to meet EMV standards in the United States.

What is PCI Compliance?

The Payment Card Industry Data Security Standard (PCI DSS) is required for any size company that accepts credit card payment processing. No matter if it’s a mom and pop business or a large-scale company, if your company accepts card payments you have to be compliant. No matter what, if your business is in Canada, Hong Kong, Italy… it still applies to PCI compliance. It is a requirement if you accept credit card payments! PCI standards apply to all Card readers, to any Point-of-sale system to processing the credit card payments. Your store networks and wireless access routers must be in compliance with a secure network. Any payment card data storage, or transmission must protect with the security levels. Online payment applications, phone app and shopping carts must have the PCI standard.

PCI host providers must also meet to protect the cardholder requirements: such as protect Cardholder Data and Private information: Protect stored data. This requirement only applies to companies that store cardholder data; Building, protecting and maintaining a strong secure network when the credit card transmits the transactions such as personal pin, password, authorization, authentication, passwords, etc…of cardholder data, private information across open to public networks; And encrypt the transitions during authorization processing.

What is NFC?

It stands for Near Field Communication. It is a type of payment between the cardholder to the Contactless Card /NFC reader devices. It is a very secure and 50% faster than cash payment. According to Yankee Group as reported in Digital Transactions in June 2009 states: “Yankee Group predicts worldwide contactless card transactions will come in at 3.5 billion this year, 7.9 billion in 2010, 15 billion in 2011, 23.6 billion in 2012, and 31.8 billion in 2013.” It accepts more than 130,000 merchant locations in the United States. NFC have been using NFC payment processing such McDonalds, Burger King, Best Buy, Starbucks, Home Depot all the gas stations, etc… Many experts believe contactless card will become one of the fastest growing form of payments in the future.

What is Apple Pay, Samsung Pay & Android Pay.

Apple saw the Contactless Card / NFC grow rapidly. Apple has taken advantage of the NFC technology in order to compete with other competitors such as Samsung. Then, Apple Pay was born Oct. 14, 2014. It became the first ever mobile payment and digital wallet in mobile phone industry. Samsung was not intimidated by Apple. After a 10-month development, Samsung Pay caught up with NFC technology and Samsung Pay opened on August 20, 2015; Then Android Pay was launched on June 28, 2016.

What is Cash Advance?

It is a working capital service for you. If you need to expand or renovate your business, to catch up on bills or taxes, to upgrade your equipment, to store more of your inventory, or doing some marketing or advertising; it is a money advance for your business when you need it. Our funding can get from $20,000 to $250,000 available according to your needs. We give you cash based on your credit cards monthly processing volume. The funding can be available in 10 business days.

What is American Express OptBlue?

Most every business owner turns down American Express (Amex) due to high fees. For small business owners this can be a big problem. They even have a sign on their business that states: “We do not accept American Express.” But later, the business owners begin to recognize that their revenue is losing date because of this. Their customers begin to look for another similar businesses that accept Amex. American Express then came out with Amex OptBlue with better low fees than before. Amex OptBlue campaigned to contact each business monthly, and give out tips how to do marketing emails, attract the customer and management tips through the OptBlue service.

Next Day Funding Program?

Are you worried about paying employees on time, need to catch up with some bills or do some other business? Our Next Day Funding Program will guarantee to deposit the funds in your bank within 24 hours after the batch out before 5:30 PM instead of the normal 48-72 hours like other processors do.

We guarantee to match or lower the rates of our competitors. We do buy 100% out your existing contract. Also, we have a rate guarantee as long as you stay with us! We give you hassle free service while doing business with Bona Fide Advisors.

24/7 Customer Services / and multi languages.

Advisors The Bona Fide Advisors Are Here To Help!

How to Calculate Profit Margin:

Learning how to calculate profit margin is a cornerstone of good business financial practices. Bona Fide Advisors focus on three of the most important areas: